- #QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL FOR FREE#

- #QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL SOFTWARE#

- #QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL TRIAL#

- #QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL PLUS#

- #QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL SERIES#

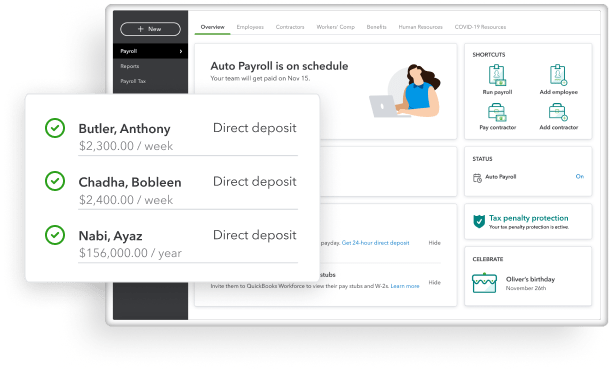

Employers will benefit from e-mail subscription and free expert support. Employees will also have round-the-clock access to their own paycheck information. The second Enhanced plan adds features such as electronically filed and paid payroll taxes state and federal forms and ability to print them (QuickBooks Payroll e-file W-2, QuickBooks Payroll e-file 941 From, 1099/1096 Form, etc.). If you need help, you can turn to free expert support These include the ability to create paychecks, direct deposits for 1099 contractors and employees, and time tracking integration. The first plan includes only the basic features that meet the requirements of most small businesses. Intuit Payroll Service offers three separate plans to meet different needs of businesses of all sizes. Although features vary depending on the plan you choose, QuickBooks will likely be able to offer everything QuickBooks Self-Employed might look for. QuickBooks Payroll comes with an extensive list of features. As with the online version, you can take advantage of discounts and a free trial. As you can see the prices for a desktop version are somewhat lower. You will pay $109 for the most advance plan, but here you will be paying $2 for each paycheck.

#QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL PLUS#

The Basic one will cost only $29 a month plus $2 for each employee, while an Enhanced plan is $45 a month plus $2 per employee. The price for QuickBooks Payroll is also based on the plan you choose. If you have a desktop version of QuickBooks, you can also add a payroll function to your software.

#QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL TRIAL#

When you sign up for the free trial, you do not need to give any payment information, but after the trial period ends and you like the service, you can make a deposit to pay for the service.

#QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL FOR FREE#

At the same time, businesses can take advantage of great discounts, such as a 50% off offer, and try the service for free for a whole month. In addition, you will have to pay from $4 to $10 for each active employee on your pay list. The monthly price for QuickBooks Payroll Online varies between $45 and $125. QuickBooks Payroll pricing is based on a flat fee that varies from plan to plan. However, if your company grew enough to have over thirty employees, we recommend entrusting this function to QuickBooks. If you do not have a lot of employees, it might make sense to do it yourself plus the whole process is very intuitive. Both systems provide a way to easily manage payroll and pay employees without much hassle and on time.Īdditionally, employers have an option to choose between doing payroll themselves or having a QuickBooks ProAdvisor handle everything for them. Intuit QuickBooks offers two versions of payroll service: a QuickBooks Payroll for desktop and an online version. In QuickBooks Desktop, users can activate QuickBooks Payroll Services, a subscription that enables payroll features. QuickBooks Accountant is a special program developed by intuit. Intuit offers bookkeeping and payroll solutions that fully integrate with each other. They can generate paychecks or direct deposits, create historical payment reports, and ensure tax compliance regulations are met.

#QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL SOFTWARE#

Luckily, there is a number of online and desktop software solutions that can simplify the process. There is also a possibility of making mistakes that can result in an employee being under or overpaid. Customer and job-related time can be challenging, but TSheets employees can track time to a specific customer or job.Payroll can be complicated and time-consuming. Time can either be tracked and approved in QuickBooks Online or inside TSheets, making it easy to run payroll. With a few steps, TSheets timesheets and time-related job time can be imported directly to QuickBooks Online Payroll.

TSheets can schedule employee jobs or shifts, send out alerts to employees, and track time through a mobile app or browser. With an active QuickBooks Online Payroll Premium or Elite subscription, TSheets can be accessed and launched directly from inside QuickBooks Online. TSheets by QuickBooks is a time tracking App that can be integrated with QuickBooks Online Payroll or used as a standalone product.

This article is focused on TSheets and QuickBooks Online Payroll.

#QUICKBOOKS ACCOUNTANT ONLINE WITH PAYROLL SERIES#

In our prior installments of this series we covered the ' basics of what you need to know', and ' essential steps in set-up'. To keep you informed, this payroll series will guide you through steps for setting up and configuring your payroll account to meet the needs of your clients' business. QuickBooks Online Payroll has launched three new payroll subscriptions: Core, Premium and Elite.

0 kommentar(er)

0 kommentar(er)